Lawrence - if people can't get mortgages anymore, who's going to buy some of that record inventory? Come on, you're an "economist" - you gotta understand supply and demand, right?

Right?

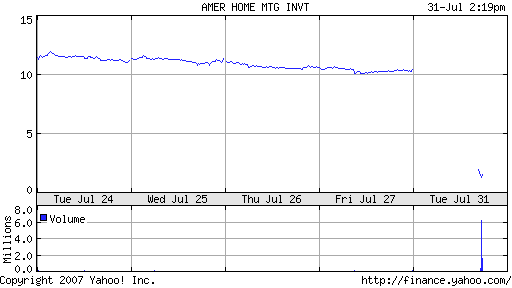

American Home plunges on bankruptcy concern - Mortgage lender hires advisers for 'orderly liquidation of assets

SAN FRANCISCO (MarketWatch) -- American Home Mortgage Investment Corp. said Tuesday it has missed margin calls from its lenders and hired advisers to consider strategic options including the liquidation of its assets.

Shares of the company plunged 90% to $1.04 on concern the company may file for bankruptcy protection.

Meanwhile, in LawrenceYunLand:

"We are encouraged that home prices, at least for now, have stopped declining," said Lawrence Yun, senior economist at NAR. "If they were to drop much larger than that, it could tip the economy into recession." The association has predicted that existing home sales will fall by 1 to 2 percent in 2007.