Monday, December 31, 2007

Saturday, December 29, 2007

Yun Bashed in Times Online

So irritating has NAR become that Yun now has his own hater blog (Lawrenceyunwatch.blogspot. com). The same people ran a blog blasting his predecessor, David Lereah.

To be fair to Yun, Lereah seems the more deserving target. Lereah is a classic booster who once advised people it was a great time to buy and to sell.

Thursday, November 29, 2007

Mr. Yun's September 2005 Prediction is Way Off

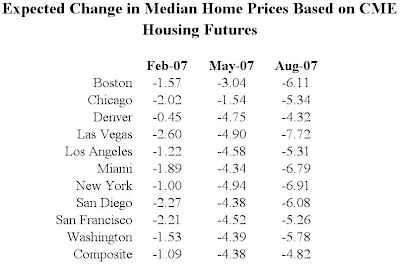

As we know prices have declined in the DC area since Yun's wrong prediction. According to the S&P Case Shiller Index, since September 2005 DC area prices have fallen 6.3%.

Do not trust Lawrence 'paid spinner' Yun. The general public and media need to be aware of his spins, predictions that have proven wrong, and his contradictory statements. Mr Yun is a paid shill who has lost his credibility.

A simple question for Lawrence Yun

What exactly is it that makes you think US home sales and prices will rebound next year?

* The record and swelling inventory?

* The worldwide crashing debt markets?

* The millions of REIC losing their jobs?

* The fact that renting is SIGNIFICANTLY cheaper than "owning"?

* The massive fraud-related demand that will NEVER come back?

* The congressional investigations?

* The disappearance of no-down, no-doc mortgages?

* The looming recession?

* The blowup over at Fannie and Freddie?

* The hundreds of mortgage companies that have failed?

* The tightened lending requirements?

* The complete loss of confidence amongst potential buyers?

* The sea of foreclosures?

* The massive wave of ARM resets

* The destruction of collateralized debt, CDOs and SIVs?

* The loss of buying power of the US dollar?

* The plunging consumer confidence index?

I could go on. But Mr. Yun, please illuminate us. You're the Senior Economist after all, and obviously we have no idea what we're talking about here. You must know something we don't know. Your detailed and sophisticated NAR financial models must be seeing something we can't see. You must think Manias, Panics and Crashes is a bunch of hooey. And you must have 21 great reasons too (the year round golf, right?).

So do tell. Please share with us your detailed financial modeling and statistical evidence that has led you as an economist to your conclusions. The floor is yours.

The market for existing homes is "hitting the low right now" and heading for a "modest recovery" next year, the chief economist for the National Association of Realtors said at the group's annual convention here Tuesday.

NAR expects the national median price of existing homes to decline 1.7 percent to $218,200 for this year and hold steady in 2008.

Yun said housing will start to recover next year, if only because people will keep getting married, having babies, changing jobs and retiring, forcing them to buy or sell homes. "The pent-up demand is there," he said.

Wednesday, November 28, 2007

OK, so Lawrence Yun reads HousingPANIC and LawrenceYunWatch. So we have a message for him...

This is gonna be a bit direct, so sorry HP'ers, but it is deserved, and it is our responsibility:

LAWRENCE YUN, GO F*CK YOURSELF.

Shall I go on? Ok.

Lawrence Yun, you go to work every day and do evil. You help ruin lives. Your parents are likely ashamed of you. Your college professors wonder where they went wrong.

Just stop. Be a man. Quit the NAR tomorrow. Come clean. You'll make MILLIONS by doing the right thing, turning against the evildoers at the NAR, versus the thousands you're making today on their leash. You'll be the star of the 2008 Senate Hearings (instead of the dick). You'll do your family proud. You'll regain your humanity. You'll do good.

Or not.

Seriously, Lawrence, life is too short to be a stooge, a pawn, a hack, a conman, a liar. Life is too short to be the paid shill of the most evil and disrespected organization in America today. Life is too short to spin lies for realtors. Life is too short to be Lawrence Yun. I truly want you to see the evil you're doing in your life, and step away from the dark side. Seriously, Lawrence. Join the forces of good. Send me a note. Quit your job. Be a man.

Meanwhile, HP'ers, here's the latest evil-doing from the man himself, care of Diana's blog at CNBC, followed by his lies to the media earlier today. God, I hope this person finds truth, reason and a sense of purpose. What hell it must be to be Lawrence Yun. Please join me in sending your personal messages to Lawrence Yun, and his masters at the NAR.

Lawrence Yun: "I'm glad we are living in a free society where we have the right for the bloggers to blog and have fun at it. So it's great that people can blog.

In terms of the forecast, we have revised down our forecast based upon all the fresh information that arrives in the latest month and as a result we think it's responsible to modify the forecast incorporating new information.

We have revised down our forecast by, I believe, by 8 straight months according to some bloggers. I have never kept track of it. I just try to make the most accurate forecasts, but because of this information I have been tracking the blue chip forecast on the housing starts, they don't have a forecast for the home sales, but on the blue chip which is comprised of Goldman Sachs and Merrill Lynch and many others, and they have revised down their housing forecasts for 20 straight months.

The fact that NAR is getting a lot of publicity, that's all good for us that people are paying attention to what we are saying, but just factual information, I think everyone from Merrill Lynch, Goldman Sachs they are revising down their housing market forecast."

And here's the infuriating lies and disinformation Lawrence Yun was forced to put out by the NAR earlier today:

As bleak as the data are, the fundamentals of the market don't support a further decline in sales, according to NAR chief economist Lawrence Yun, who said low mortgage rates and job growth should keep sales from falling. While the subprime mortgage market has disappeared, the Federal Housing Administration is picking up its lending.

"I don't anticipate any further major sales declines," Yun said. However, the NAR didn't anticipate the sales declines of the past two years, and it's been predicting a bottom nearly every month since early 2006.

If sales do continue to fall because of negative market psychology aided by "sensationalized" news reporting, "it would be a major concern" and "would raise the risk of an economic recession," Yun said.

Monday, November 19, 2007

Yun: Florida is Ground Zero for Housing

Thursday, November 15, 2007

Yun Makes Misleading Investment Comparison

“Home buyers in it for the long haul nearly always come out ahead in building wealth. Given the leverage in purchasing a home, the average return on a 5 percent downpayment over 10 years is usually three to five times greater than stock market returns,” he said. “When people compare investment returns, they often overlook the power of leverage in the housing market.”

Yun said a $10,000 downpayment on a median-priced home, at a typical appreciation rate of 5 percent, would be worth $110,000 after 10 years. That same amount invested in the stock market for the same amount of time, assuming 10 percent annual appreciation, would be worth $23,600. “That’s why housing is the best long-term investment most families ever make – the longer you own, the better your investment,” he said. (Realtor.org 11/12/07)

Yun you are intentionally misleading. Stocks don't require monthly mortgage payments, yearly taxes or maintenance costs. Housing units do. Lawrence 'paid misleader' Yun cannot and should not be trusted.Wednesday, November 14, 2007

Tuesday, November 06, 2007

Lawrence Yun Promoted to Chief Economist

The National Association of Realtors® today named Lawrence Yun chief economist and senior vice president of research. Yun has served at NAR since 2000, most recently as vice president and senior economist.

“Lawrence is a talented economist and an outstanding forecaster who has contributed greatly to NAR’s growth and prestige as the leading advocate for the housing industry,” said Dale Stinton, NAR executive vice president and chief executive officer. “We are proud to have a man of Lawrence’s integrity and honor.

“He is a no-nonsense and level-headed analyst of the housing market who calls the data as he sees it, and has guided NAR with skill as chief spokesman for the past several months in a competitive real estate market. We have great faith and trust that Lawrence’s tenure will be a stellar one that will enhance NAR’s reputation as the most reliable and credible source of real estate research.”

Mr. Yun is not an 'outstanding forecaster;' his forecasts have been way off the mark. In September 2005 he predicted "The chance of a housing price decline in the DC area is close to zero, in my view. I anticipate that prices in DC will outpace the national average price growth. DC prices will rise at close to a 7 to 10 % rate of appreciation. " As we know priced have declined in the DC area since Yun's wrong prediction.

Do not trust Mr. Lawrence 'paid spinner' Yun. The general public and media need to be aware of his spins, predictions that have proven wrong, and his contradictory statements. Mr Yun is a paid shill who has lost his credibility.

Sunday, November 04, 2007

LawrenceYunWatch Stupid Question of the Day

Wednesday, October 24, 2007

Lawrence Yun Spins And Misrepresents Data

- National: Months supply of housing increased from 9.6 in August 07 to 10.5 this month

- National: Months supply of housing increased from 7.3 in September 06 to 10.5

- National: Inventory was up .4% this month compare to last and up 16.3% over last September

- National: September 07 Seasonally Adjusted Sales Numbers vs last month -8%

- National: September 07 Seasonally Adjusted Sales Numbers vs last year -19.1%

- National: September 07 Not Seasonally Adjusted Sales Numbers vs last month -28.9%

- National: September 07 Not Seasonally Adjusted Sales Numbers vs last year -22.7%

They quickly turned their spin machine into overdrive. Lawrence Yun blamed 'temporary' problems in the mortgage market and assured us these mortgage 'problems' were already improving.

Lawrence Yun, NAR senior economist, said the decline is understandable. “Mortgage problems were peaking back in August when many of the September closings were being negotiated, and that slowed sales notably in higher priced areas that rely more on jumbo loans,” he said. “The good news is that mortgage availability has markedly improved in recent weeks with interest rates on jumbo loans falling, and more people are applying for safer and conforming FHA mortgage products. Some of the cancelled transactions will move forward as buyers apply for other loans.”

Mr. Yun went on to say that prices were really rising in many area.

“Because there were fewer transactions at the upper end of the market, there is a downward distortion reflected in a lower national median home price. Home prices continue to trend up in the Northeast and in the condo sector. In other areas not dependent on jumbo loans, such as much of the Midwest, prices are rising.”

The evidence shows that overall prices are not rising in both the Northeast and the condo market. Look at the Case Schiller Index as well as date from the Massachusetts Association of Realtors.

Remember last year in September the NAR reported "Total existing-home sales -- including single-family, townhomes, condominiums and co-ops -- dipped 1.9 percent to a seasonally adjusted annual rate1 of 6.18 million" David Lereah the NAR's cheif economist, and Yun's boss at the time said "this is a lagging indicator and the worst is behind us as far as a market correction -- this is likely the trough for sales." Since then the seasonally adjusted rate is down 19% to 5.04 million. Some trough? The NAR's spokespeople cannot be trusted as they are paid shills who give propagandist predictions. They are super spinners.

Thursday, October 11, 2007

No Yun! Speculative Prices Still Exist

Wednesday, September 26, 2007

Stupid, uninformed and deceptive Lawrence Yun Quote of the Day

Uh, Larry, those horrific cancellation numbers you're seeing are because home prices are crashing and people aren't believing your BS anymore.

The fact that people can't get toxic loans and jumbos anymore is actually the only thing saving them from making the worst financial mistake of their lives.

Nice try though Larry.

Wednesday, September 05, 2007

Yun Spins Large Declines In Pending Home Sales

The National Association of Realtors said its seasonally adjusted index of pending home sales for July fell 16.1 percent from a year ago and 12.2 percent from the prior month.

Lawrence Yun, the Realtors trade group's senior economist, called the problems "temporary," and related to jumbo home loans above $417,000 ..(AP Business 9/5/07)"

The depression was also temporary. The housing market in many parts of the US is undergoing large price declines, falling construction starts and lousy sales. The housing market is not ready to 'bottom out' or 'stabilize.' There will be many more years of this housing bust. Mr. "Spinner in chief' Yun is a paid shill who cannot be trusted.

David Lereah has admitted he was wrong. Can't You?

Wednesday, August 29, 2007

LawrenceYunWatch and HousingPANIC have a message for Lawrence Yun and the NAR

Message to Lawrence Yun and the NAR: Kiss our blogger butt.

Message to Lawrence Yun and the NAR: Kiss our blogger butt.So you think we're the ones responsible for the declining median home price?

So you think we're to blame for record inventory?

I guess the mortgage meltdown is all our fault?

Look in the mirror Lawrene Yun. And give your buddy David Lereah a ring too.

So, do you think America has gotten the message that Lawrence Yun, like David Lereah before him, is an untrustworthy, discredited hack?

Here's a REALLY harsh look at Yun and the NAR from housingpanic supporter Seth Jayson at Motley Fool:

Tuesday, July 31, 2007

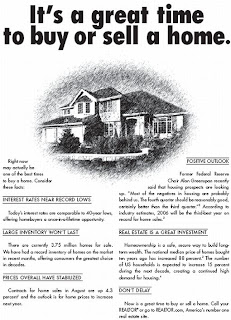

FLASH: American Home Mortgage melts down - stock falls 90%. Lawrence Yun still thinks housing will be fine and dandy.

From HousingPANIC: Real Economist (NOT Lawrence Yun) Quotes of Brilliance

"No one is buying into their Kool-Aid; that's why prices are falling"

- Paul Kasriel, chief economist with Northern Trust in Chicago, questioned the Realtors' assessment that this is a good time to enter the market, saying weak sales and prices suggest that potential buyers are smart to be sitting on the sidelines right now.

Thursday, July 26, 2007

Lawrence Yun says potential homedebtors are getting "mixed signals, causing them to hesitate". Let us help clear that up.

POTENTIAL HOMEDEBTORS - FOR THE LOVE OF GOD AND ALL THAT IS HOLY, DON'T EVEN THINK ABOUT BUYING A RAPIDLY DEPRECIATING HOME. THIS MARKET CRASH WILL TAKE YEARS TO PLAY OUT

-Sincerely, your friends at LawrenceYunWatch

Wednesday, July 25, 2007

Yun: "buying conditions remain favorable for long-term home buyers"

Friday, July 20, 2007

Lawrence Yun points out that a 70% crash in new household formation is "very unusual". Nice job Larry! Master of the obvious!

When homes get so expensive that nobody can afford a home, guess what?

When homes get so expensive that nobody can afford a home, guess what?New household formation plummets and home prices crash.

Saturday, July 14, 2007

Yun says rising apartment rents will create housing turnaround in 2008. Not a chance in hell Larry, and you know it

Thursday, July 12, 2007

The Confused Lawrence Yun's quote of the day

''Housing will continue to be a drag to economic growth all the way through 2008"

Tuesday, July 03, 2007

LA Times real estate writer destroys Lawrence Yun and the NAR

Oh, now we understand. This entire slowdown in home-buying, the collapse of the subprime lending industry, the surge in bankruptcies, it's our fault -- bloggers and journalists made this happen.

This, at least, is the thrust of an essay by Lawrence Yun, the senior economist for the National Assn. of Realtors. Read the whole thing here. Highlights:

"To a great extent, we can thank steady media coverage of the real estate market “correction” for unfounded consumer concerns.... But there’s no real correction where consumers are concerned. Yes, home price appreciation has slowed considerably, and nationally we’re expecting a price drop of 1% for 2007. But that drop comes at the tail end of a five-year spurt that increased home prices by 53%. We may have taken one small step back, but that’s after taking 53 steps forward."

More: "When today’s consumers look at real estate markets, they need to use the same analytical approach as investors in the stock market. Those buyers aren’t generally concerned about the volume of stock trades on a given day. Why should they be? They’re focused on price trends. And by that measure, now is a great time for consumers to be in the housing market: Prices have steadied, and inventories are healthy."

Yun replaced David Lereah, who was widely criticized -- ridiculed is more accurate -- on blogs for being a cheerleader for the housing bubble. This essay will earn Yun similar attention -- in fact, there's already at least one blog dedicated to yun-watching, www.lawrenceyunwatch.blogspot.com.

Friday, June 29, 2007

Lawrence Yun Contradicts Himself

Even a relatively large price decline, such as the 12 percent drop we saw in Sarasota, Fla., cannot reasonably be called a correction when that market had a 150 percent price increase during the boom.

However, in a May 2007 powerpoint presentation (pdf), Mr. Yun himself used the term 'price correction'

The discredited Lawrence Yun has contradicted himself. The general public and media need to be aware of his spins, predictions that have proven wrong, and his contradicty statements. Mr Yun is a paid shill who has lost credibility.

Lawrence Yun just doesn't know when to shut up

Here's the latest from Yun. Weigh this against the latest from Case Shiller.

Consumers are hearing a lot in the media about the correction in housing, and they’re understandably concerned about whether now is a good time to get into the housing market.

To a great extent, we can thank steady media coverage of the real estate market “correction” for unfounded consumer concerns.

If there’s a correction in markets today, it’s in home sales volume and housing starts, not in home prices.

Even a relatively large price decline, such as the 12 percent drop we saw in Sarasota, Fla., cannot reasonably be called a correction when that market had a 150 percent price increase during the boom.

Monday, June 25, 2007

First time home buyers plummet 70%. Yun actually points it out. Recession anyone? Housing crash everyone?

Big drop in new household formation in Yun's numbers today. And nice to see Yun being called "crafty". He he he.

Big drop in new household formation in Yun's numbers today. And nice to see Yun being called "crafty". He he he.Yun Blames Housing Woes on 'Psychological factors'

NAR senior economist Lawrence Yun said, 'I think psychological factors are currently the biggest drag on the housing market.' While subprime problems are still a 'headwind,' he said.

"The market is underperforming when you consider positive fundamentals such as the strength of job creation, economic growth, favorable mortgage interest rates and flat home prices," Yun said

Monday, June 18, 2007

Sunday, June 17, 2007

Needed Lawrence Yun Article on Wikipedia

Wikipedia is lacking an article about Lawrence Yun. An article would be be useful in many ways, as it will inform people of who Lawrence Yun is, it will have a section with criticism of Mr. Yun, and will provide a link to the Lawrence Yun Watch.

Wikipedia is lacking an article about Lawrence Yun. An article would be be useful in many ways, as it will inform people of who Lawrence Yun is, it will have a section with criticism of Mr. Yun, and will provide a link to the Lawrence Yun Watch. Anybody want to create a Lawrence Yun article on Wikipedia? Are you itching to put up the criticisms section of the article?

A LawrenceYunWatch message to Lawrence Yun: Just shut up. Really. Just shut up.

Dude, when you find yourself in a hole, quit digging.

Dude, when you find yourself in a hole, quit digging. After encouraging flippers to game the system for years (so realtors could make their comissions), NOW the NAR and Lawrence Yun say no to flipping

I guess the NAR will send a letter to A&E to take down all their Flip This House type shows, I guess they'll apologize for TCDL's books, I guess they'll instruct their 1.2 million ramen eaters to not take flippers as clients, or to flip houses themselves, and I guess they'll apologize for their cheerleading these past few years which SHOUTED to anyone who would listen than housing was a slam dunk investment that would soar in value.

I guess the NAR will send a letter to A&E to take down all their Flip This House type shows, I guess they'll apologize for TCDL's books, I guess they'll instruct their 1.2 million ramen eaters to not take flippers as clients, or to flip houses themselves, and I guess they'll apologize for their cheerleading these past few years which SHOUTED to anyone who would listen than housing was a slam dunk investment that would soar in value.It's official - Lawrence Yun is a distorting, deceptive spinmeister, just like TCDL

It didn't take TCLY long to pick up for TCDL. You wonder if there's a training class for NAR "economists" - called "how to lie, deceive, distort and spin".

It didn't take TCLY long to pick up for TCDL. You wonder if there's a training class for NAR "economists" - called "how to lie, deceive, distort and spin". When's the book coming out Larry? Maybe "Housing Crash My Ass - Why Housing Prices Will Soar! - The Fundamentals Don't Matter" or something like that.

I could just imagine the scene of this realtor luncheon (brown bags - nice. Ramen noodles next time?). And there you have Larry Yun, tellin' 'em what they want to hear. Versus this little thing called 'the truth' that most of us would expect to hear from an 'economist'.

Folks, the NAR is a discredited joke of an institution, run by monkeys, and now represented by TCLY.

He's down on the mat, he's bloody, the fans are booing. But can the Tampa Bay area housing market rise from the arena as the Comeback Kid?

You can bet the house on it, said Lawrence Yun, senior economist at the National Association of Realtors.

Yun was appointed last month as the top economic spokesman for the Washington-based Realtors group. He succeeded economist David Lereah, discredited after maintaining rosy outlooks amid an increasingly troubled housing market and promoting his 2005 book, Are You Missing The Real Estate Boom - Why Home Values and Other Real Estate Investments Will Climb Through the End of the Decade.

In a slide show Thursday to the Greater Tampa Association of Realtors, Yun delivered a message of short-term pain leading to long-term gain.

"Five years from now you will be very happy you're in this business and located in Tampa," Yun said over a brown-bag lunch to about 75 real estate agents.

In Yun's view, rising incomes and declining home prices ought to have stimulated sales this year were it not for housing bubble scares in the media.

In one worst-case scenario, an economist suggested the gap between incomes and home prices would depress housing values 40 percent.

Yun scoffed at the idea: The real measure of affordability, he said citing a formula, is mortgage obligation relative to income. He clicked a slide showing Tampa-St. Petersburg-Clearwater hovering at the national average. Much of California isn't so lucky, nor is high-priced Miami and Naples.

"It's very, very manageable. Nothing alarming in this region," Yun said.

Friday, June 15, 2007

OK folks, time for a little street theatre. We're gonna send ramen noodles to Lawrence Yun at the NAR

The HousingPANIC "Realtors are People Too" Top Ramen Drive

The HousingPANIC "Realtors are People Too" Top Ramen DriveHere's all you have to do:

Pick up a few packages of ramen at your local store, and send 'em off to:

Lawrence Yun

National Association of Realtors

430 N Michigan Ave.

Chicago, IL 60611

Include a note "Keep up the great work Lawrence! Your lies and spin make us laugh every day! Love, your friends at HousingPANIC". Or just do your own thing. He'll get the point.

Post here if you've sent a package off, and I hope he finds a fair way to distribute the goodies to the 1.2 million hungry little guys. At least they'll get something for their NAR dues.

Lawrence Yun is bad with math

What a flaming idiot. In recent commentary for a NAR's online real estate journal, TCLY had this gem of wisdom:

What a flaming idiot. In recent commentary for a NAR's online real estate journal, TCLY had this gem of wisdom:The word “correction” is a misnomer applied all too frequently in a misleading way. What homeowners and homebuyers are monitoring is principally where home prices have been and where they are headed. Nationally, the median home price rose 1 percent last year – that on top of the 53 percent rise during the five-year boom from 2000 to 2005. This year, the national median price is expected to fall 1 percent.

By any standards, it is an extreme stretch to call it a correction when a particular asset price rises better than 50 percent and then retreats one percent. Even a relatively large price decline of 12 percent in Sarasota cannot reasonably be considered as a correction when its local market had a 150 percent price increase during the boom. Let’s see, that is 150 steps forward and 12 steps backwards.

Thursday, June 14, 2007

Corrupt dot-com poster boy Henry Blodget compares housing crash rhetoric & predictions to dot-com crash. Is Yun the new Blodgett?

Those of you who had the misfortune to live through the dotcom crash will recall that I and other analysts correctly predicted that there would be a slowdown and shakeout, but drastically underestimated its severity and duration.

Motley Fool throws Lawrence Yun under the bus

Ouch. That's gotta hurt.

Ouch. That's gotta hurt.To all of the various problems affecting U.S. housing, we can now add a case of schizophrenia.

And as if these divergent opinions weren't enough, the U.S. Commerce Department reported on Wednesday that construction of new homes and apartments rose by 2.5% in April, but still remained nearly 26% below the year-ago level. At the same time, April permits were down 8.9%, clearly substantiating the NAHB group's sentiment.

Get out the crackpipe - Lawrence Yun wants you to take a hit

When wil these guys quit? For the love of god, when will these guys quit?

When wil these guys quit? For the love of god, when will these guys quit?From the Creators of DavidLereahWatch & HousingPANIC: You asked for it, you got it, it's LawrenceYunWatch!

He made us do it folks... He made us do it..

He made us do it folks... He made us do it.. David (from bubblemeter and davidlereahwatch) and I are going to stay on top of Yun (TCLY), who is now the NAR's trained poodle, picking up right where TCDL left off.

Someone had to do it...

This tidbit is what should prove to everyone that the NAR is completely discredited, they're run by monkeys, and Lawrence Yun has sold his soul to the devil for a tiny bag of gold.

Lawrence - it's not too late. Resign, stop your evil deeds, repent, come clean, and move away from the Dark Side. People are laughing at you!

“We continue to experience a temporary distortion in comparing median existing-home prices,” Yun said. “Because the sales volume has shifted from many high-cost areas to moderately priced markets, we’re not getting a true apples-to-apples comparison. When you look at other measures, such as this week’s price index from Freddie Mac which is based on repeat sales, overall home prices are rising slowly.”

“Buyers today need to have a traditional view that housing as a long-term investment is an added benefit to their shelter expense. If so, that investment generally will build a nice nest egg over time, especially if they use a traditional mortgage instrument that reduces debt,” Yun said.