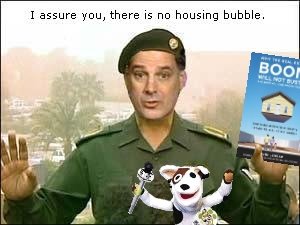

Man, if this ain't the pot calling the kettle black, but maybe he's found jesus. Henry Blodget, the dot-com guru you remember, who was publicly pumping internet stocks while privately calling them hunks of junk, and was eventually discredited and convicted of fraud, well, he's throwing Lawrence Yun and the discredited NAR to the wolves.

But I guess the guy knows what he's talking about - he WAS Lawrence Yun just a few years ago...

Henry Blodget - NAR: Don't Worry, Housing Prosperity Just Around Corner

I can't help but note the similarities between the dotcom-crash rhetoric/predictions back in 2000 and the housing-crash rhetoric/predictions in the last 12 months.

Those of you who had the misfortune to live through the dotcom crash will recall that I and other analysts correctly predicted that there would be a slowdown and shakeout, but drastically underestimated its severity and duration.

Those of you who had the misfortune to live through the dotcom crash will recall that I and other analysts correctly predicted that there would be a slowdown and shakeout, but drastically underestimated its severity and duration.

All the way down, we kept revising forecasts (read: cutting estimates) to previously inconceivable levels, and each time we cut them, we reiterated our expectation that the inevitable trough and upturn was about six months away.

It wasn't until two years after the shakeout began, when half of online advertising revenue had evaporated and more than 75% of the companies in the sector had keeled over that the downturn finally ended... And by that time, most of us were so demoralized that we'd stopped predicting that there would ever be an upturn.

Housing obviously won't experience as deep a correction as the dotcoms did, but I haven't heard a single persuasive argument explaining why this downturn won't look like every previous housing downturn: i.e., will last a lot longer and drop much farther than most people think -- until price/rent and price/income ratios return to or below their long-term trend.

Instead, all I hear are arguments like this one, which are based not on long-term historical trends, but on short-term bubble-year pricing and price trends (arguments I am very familiar with, having made similar ones in late 2000 and early 2001):

"Overall housing levels are historically strong, but sales remain sluggish compared to the recent boom," said Lawrence Yun, NAR senior economist, in a statement. "Home sales will probably fluctuate in a narrow range in the short run, but gradually trend upward with improving activity by the end of the year," Yun added. Existing home sales are projected to rise 3.7% in 2008, to 6.41 million, according to NAR's forecast.

1 comment:

Great post and yes, this has come full circle now from the dot-com days.

If you want a leading indicator that All is Not Well and the NAR knows it (but can't say it straight), count up the number of modifyers ending in "-ly" that are are written into the announcements.

NAR weasel words from this post alone:

" ... housing levels are historically strong ... Home sales will probably fluctuate in a narrow range in the short run, but gradually trend upward ... "

Mitigate. Hedge. Vascillate. Obfuscate. You get the sense that NAR quotes are more vetted than those of the Presidential candidates.

Post a Comment